Successful Track Record

History of Strong Performance

Our business model has been built to have tremendous flexibility and adapt with the times. Throughout our 48-year history as a Company, we have maintained an unwavering focus on executing our off-price business model which has generally allowed us to deliver steady sales and earnings growth through many retail and economic environments. Over the course of our history, our strong financial results and cash flow generation have allowed us to simultaneously invest in the growth of the business and return significant value to our shareholders. Our strong sales and profitability performance in Fiscal 2025 underscores our great confidence in the outlook for our business.

Longer term, we believe significant opportunity remains for us to deliver value to more consumers, capture additional market share across the globe, and further increase our profitability. At TJX, our commitment to value has been our mission since day one and we have never wavered. We are convinced that our flexible, off-price model and combination of brand, fashion, price, and quality will continue to be our winning retail formula going forward.

As we pursue our long-term goals for global growth, we see our major strengths as the following:

- Largest off-price retailer in the U.S. and internationally

- One of the most flexible retail business models in the world

- Our value proposition appeals to customers spanning a wide demographic reach

- World-class buying organization

- Global sourcing and distribution capabilities

- Integrated global business with all four segments having more than 30 years of off-price operating expertise and knowledge in the U.S., Canada, and Europe

Product Availability

Why We Have Always Had Plenty of Product Available

In our 48-year history as a Company, availability of quality product has never been an issue even as we have grown to over 5,000 stores.

Over the years, we have built a flexible, value-driven, “global sourcing machine.” We have over 1,300 Associates in our buying organization, operate buying offices around the world, and source product from more than 100 countries. Further, we have a global buying presence and source from a vendor universe of more than 21,000 vendors. Our buyers are typically in the marketplace every week, and with “no walls” between departments in our stores, we can shift merchandise categories to take advantage of market opportunities and adjust to changing consumer preferences. We are able to buy in many different ways and are typically willing to purchase less-than-full assortments of items, styles, and sizes, as well as quantities ranging from small to very large. We’re confident that we can continue to offer consumers an exciting mix of quality products in our stores and online today and in the future.

Global Growth

Long-term Global Growth of Our Off-Price Value Company

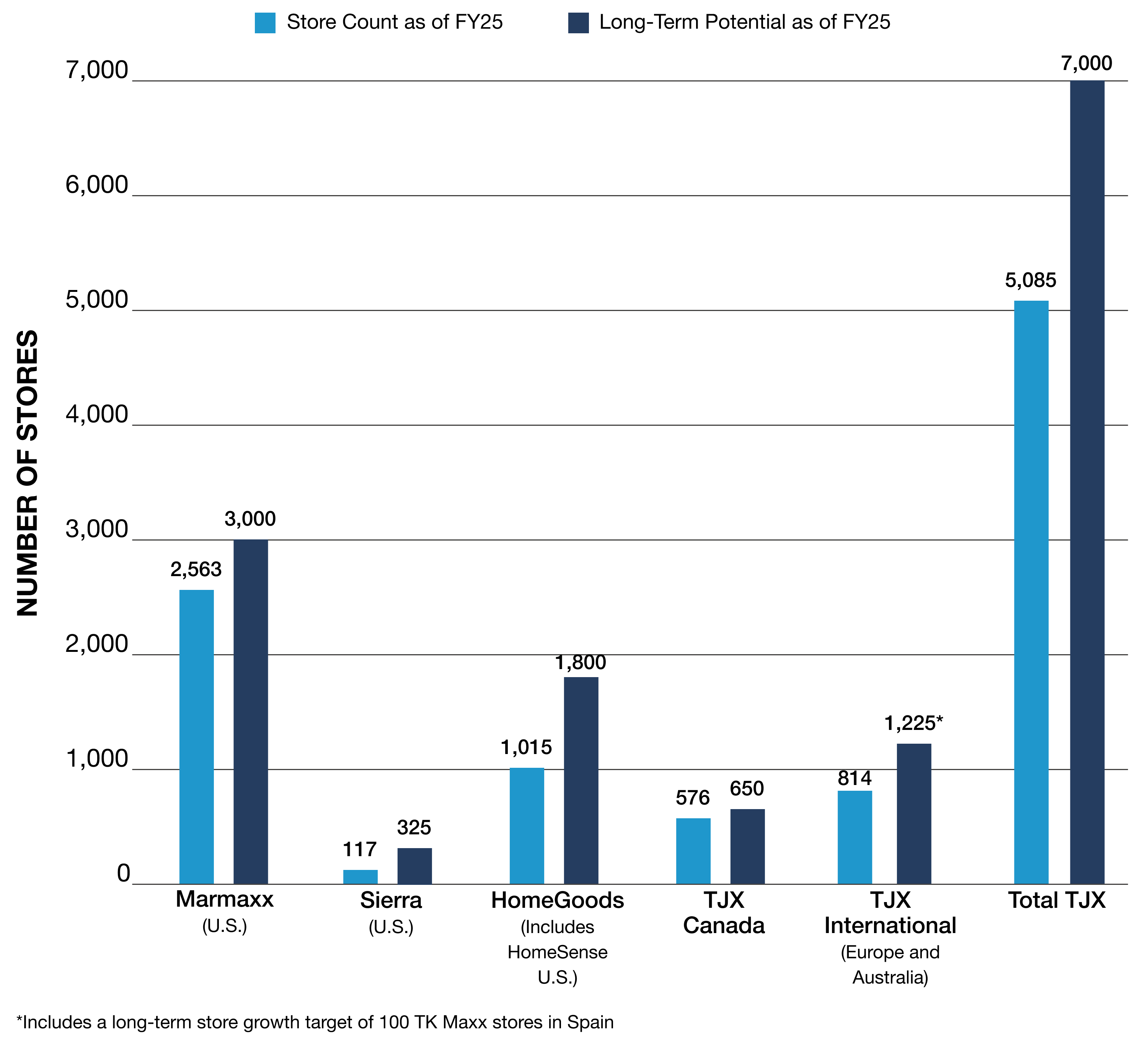

We see excellent opportunities to further grow our global store base and bring our great values to even more consumers around the world. With over 5,000 stores across our four segments, we believe we can increase our overall store base to a total of 7,000 stores over the long term, with our current banners in our current and planned geographies. This reflects the long-term potential we see for a total of 3,000 TJ Maxx and Marshalls stores in the U.S., 325 stores for Sierra, 1,800 HomeGoods and Homesense stores in the U.S., 650 stores for TJX Canada, and 1,225 stores for TJX International, which now includes a target of 100 stores in Spain, with the first stores expected to open in early 2026.

Our ability to leverage our global teams, infrastructure, and operational expertise are some of the major reasons for our confidence in being able to open additional stores around the world over the long term.

Beyond our successful brick-and-mortar business, we see e-commerce as complementary to our stores and another way to expand our customer base. We have six e-commerce sites that offer consumers differentiated merchandise and great values. In the U.S., we operate tjmaxx.comOpens new window, marshalls.comOpens new window, and sierra.com. In Europe, we operate tkmaxx.comOpens new window in the U.K., tkmaxx.deOpens new window in Germany, and tkmaxx.atOpens new window in Austria.

In 2024, we also made investments with established off-price retailers in additional geographies around the world. We formed a joint venture with Grupo Axo in Mexico and made a minority investment in Brands for Less in the Middle East. We see both of these investments as an additional way to participate in the growth of off-price in different areas of the world over the long term.

FY25 growth and long-term growth of TJX measured in number of stores.

- Marmaxx as of FY25: 2,563

- Marmaxx long-term: 3,000

- Sierra as of FY25: 117

- Sierra long-term: 325

- HomeGoods as of FY25: 1,015

- HomeGoods long-term: 1,800

- TJX Canada as of FY25: 576

- TJX Canada long-term: 650

- TJX International as of FY25: 814

- TJX International long-term: 1,225*

- Total as of FY25: 5,085

- Total long-term: 7,000

*includes a long-term store growth target of 100 TK Maxx stores in Spain.

Reinvesting/Shareholder Value

Strong Financial Position, Returning Value to Shareholders

We take a prudent approach to our capital structure to support the business and the long-term success of our Company. Over the course of our history, our strong financial returns and cash generation have allowed us to simultaneously invest in the growth of the business and return significant cash to shareholders. Our “A” S&P Global rating is one of the strongest in retail, and we are committed to maintaining a strong rating. We believe this is an important metric for our vendors, landlords, and other business associates.

In Fiscal 2025, we generated $6.1 billion in operating cash flow and ended the year with $5.3 billion in cash. We have a very strong balance sheet and continue to generate a tremendous amount of cash flow.

Additionally, we returned $4.1 billion to shareholders through our buyback and dividend programs in Fiscal 2025. We are in a great position to continue investing to support the growth of our business while simultaneously returning significant cash to our shareholders.

References on this page are as of February 1, 2025, which was the end of the Company’s fiscal year.

Updated June 2025 unless otherwise noted.